german tax calculator berlin

Annual gross income 34000. If you wish to calculate your salary Social.

German Income Tax Calculator All About Berlin

According to our salary calculator for Germany thats a net salary.

. This German salary calculator is designed to give you a pretty good estimate of how much you can expect to take home after taxes and. It will naturally be the biggest deduction and is mandatory for anyone earning over 9000 a year. For this example I assume that you also have to pay.

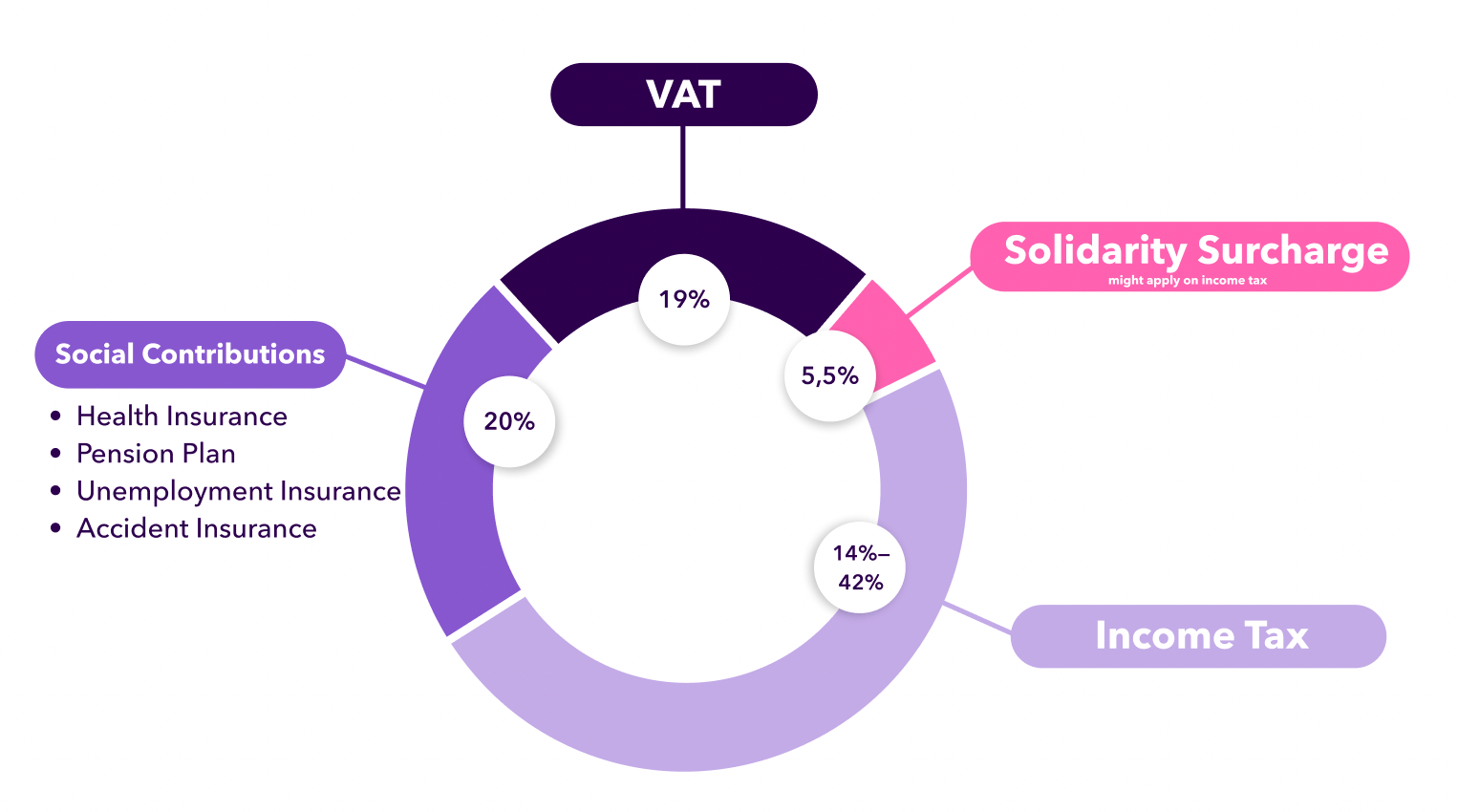

Our grossnet calculator enables you to easily calculate your net wage which remains after deducting all taxes and contributions free of. German Wage Tax Calculator. From 58597 117194 all the way to 277825 555650 taxed at a flat rate of 42.

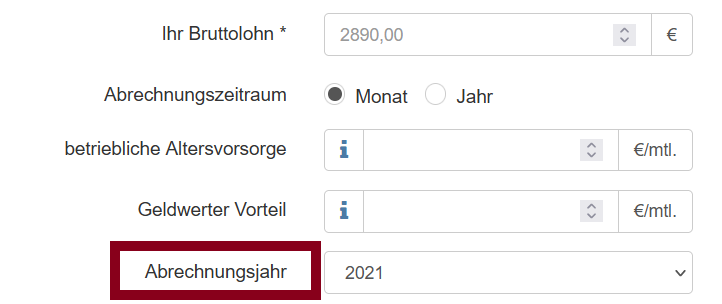

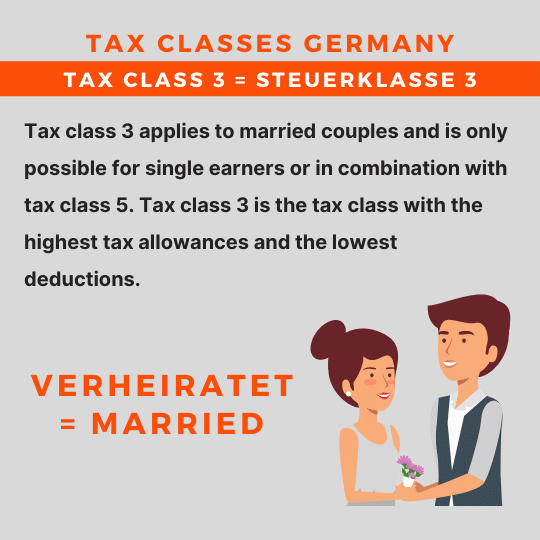

An employee with an yearly income of 9744 wont have to pay income tax for married employees the limitation will be 19488. For both instances I will assume a monthly gross salary of 3500 Euros in the accounting year 2022 the tax class 3. Submit your German tax return no tax knowledge needed simple interview questions helpful tips maximize your tax refund.

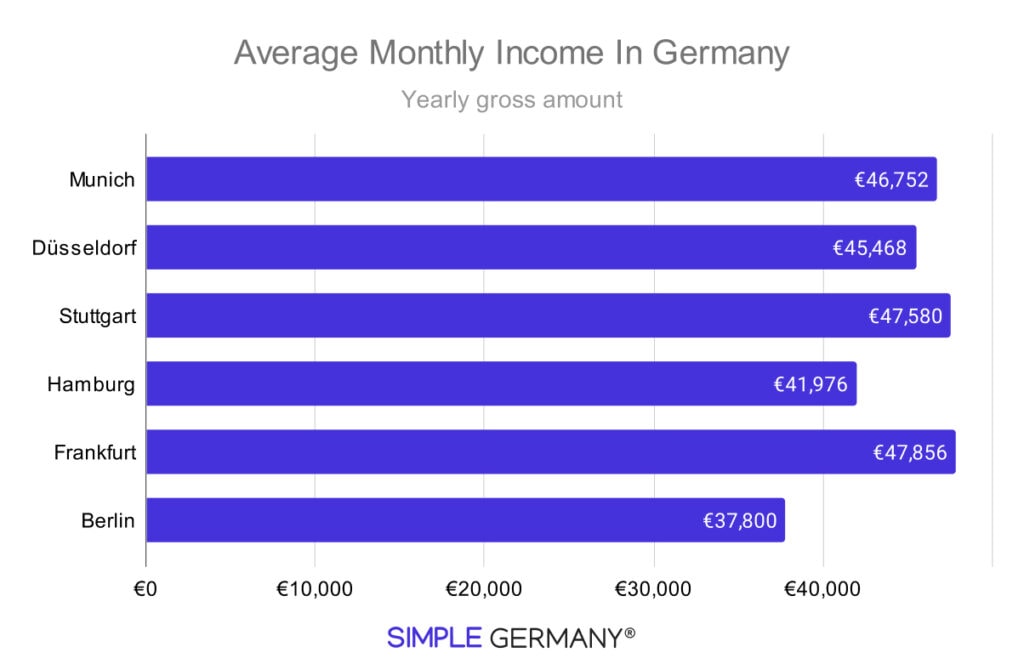

Try our free and easy-to-use tax calculator to see how much you have to pay as corporate tax dividend tax and Value Added Tax in Germany as well as detect the existence of. Considering that the average full-time employee works 41 hours a week this works out to 2132 a month or 25584 a year. Wage Tax in Germany Lohnsteuer.

Freelance in Germany My Startup Germany. This Wage Tax Calculator is best. Berlin once again became the.

1881 2005. About this German salary calculator. The German Annual Income Tax Calculator is updated to reflect the latest personal Tax Tables and German Social Insurance Contributions.

Calculate here quickly easily and for free how much net remains of your gross salary. All you have to do is select the federal state in which you reside. A minimum base salary for Software Developers DevOps QA and other tech professionals in Germany starts at 40000 per year.

This program is a German Wage Tax Calculator for singles as well as married couples for the years 2010 until 2022. Integrated optimization checks a live tax refund calculator. This Income Tax Calculator is best suited if you.

How much of my salary actually ends up in my account. Gross Net Calculator 2022 of. 100 Working Berlin sales tax calculator Updated 2021 and providing the best and accurate results you can get non other than on 360 taxes.

Our tax calculator for Germany Steuerrechner can estimate your take-home salary and total taxes due in just a few clicks. Brutto Netto - Tax Calculator Germany. From 9985 19970 to 58596 117192 taxed at a rate of between 14 to 42.

This program is a German Income Tax Calculator for singles as well as married couples for the years 1999 until 2022. Income tax payable on your salary.

Premium Photo German Annual Income Tax Return Declaration And Calculator Lies On Accountant Table Close Up The Concept Of Taxpaying Period In Germany

Income Tax For Freelancers How Much Tax Do I Have To Pay In Germany Accountable

How To Germany Paying Taxes In Germany

What Is Considered A Good Salary In Germany Detailed 2022 Guide

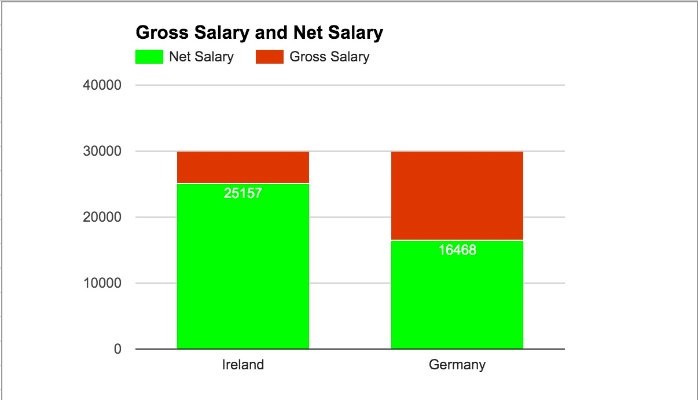

Income Tax Germany Versus Ireland

How To Calculate Your Net Salary In Germany In Three Minutes

Income Tax In Germany For Expat Employees Expatica

93 000 After Tax De 2022 Germany Income Tax Calculator

Taxes In Germany Vs Us Full Comparison 2022

German Tax Calculator Easily Work Out Your Net Salary Youtube

Salary Calculator Germany 2022 User Guide Examples Gsf

Salary Calculator Germany 2022 User Guide Examples Gsf

Germany S Vehicle Tax System Small Steps Towards Future Proof Incentives For Low Emission Vehicles International Council On Clean Transportation

German Income Tax Calculator All About Berlin

German Vat Calculator Vatcalculator Eu